MICR: What It Is And How It Works?

| Apr 03, 2024What is a MICR? In modern banking, MICR, short for Magnetic Ink Character Recognition, is an important innovation. It changed how our banks handle checks, making transactions faster and more efficient. In this guide, let’s explore what MICR is, how it works, and why it’s essential in today’s digital age. Let’s get started!

In this guide, we will discuss:

- MICR: What Does It Mean?

- Magnetic Ink Character: How Can It Be Read?

- Magnetic Ink Character Recognition: Advantages and Disadvantages

- MICR Printing: Things You Need For Printing

- MICR: Additional Ways To Use It

MICR: What Does It Mean?

Magnetic Ink Character Recognition, also known as MICR line and read as “micker,” is a strip of characters found at the bottom left of a check. This includes essential information about the bank account and the check itself. The American Bankers Association (ABA) created this technology in the late 1950s to help machines read checks faster and more accurately. The characters are printed using magnetic ink or MICR toner, such as HP 26X MICR toner cartridge, so machines can easily recognize even if marks or signatures are on the check.

So, what are some of its components?

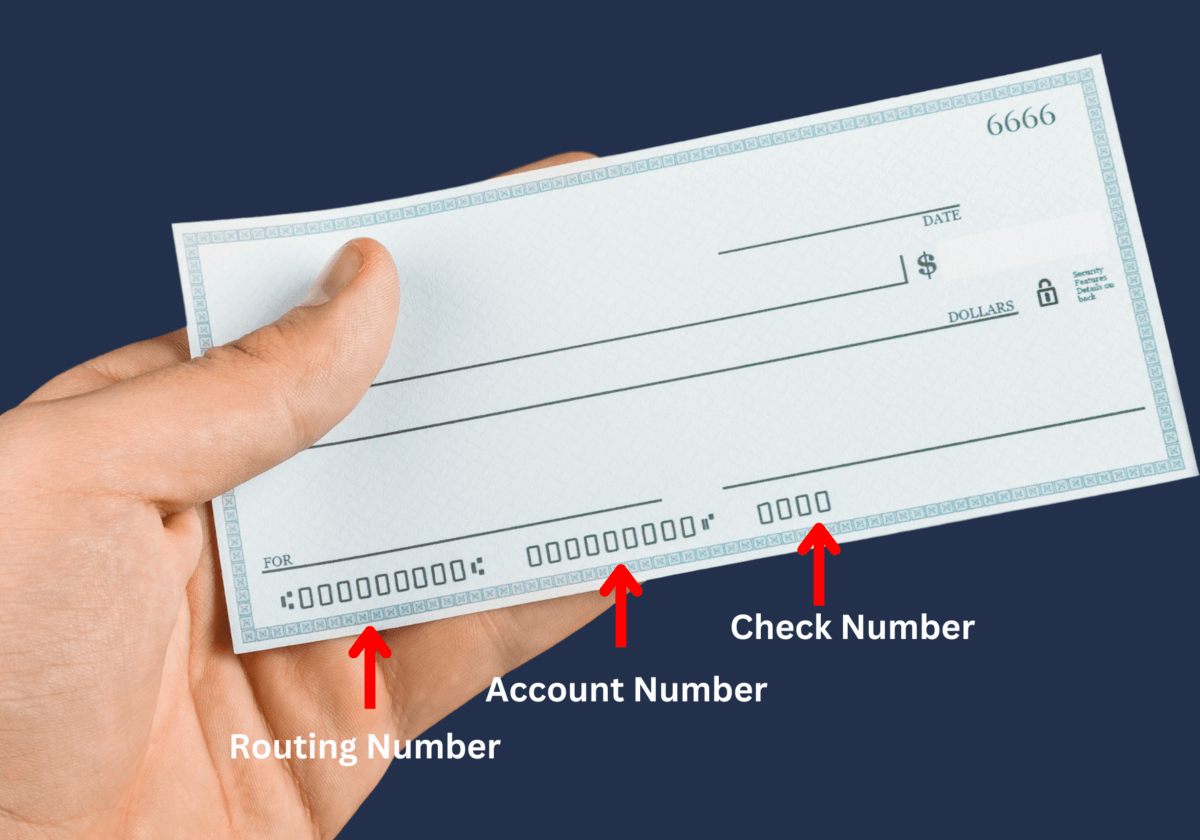

1. Routing Number

The routing number is like a bank’s ID number, helping to show which bank the check belongs to. It’s nine digits long and is assigned based on the state where the bank is located.

2. Account Number

Account numbers usually have 8 to 12 digits, but some can be as long as 17 digits. Each checking account has its unique number. It also tells the bank which accounts the money should come from or go into. So, every check for a specific account at a bank will have the same account number.

3. Check Number

The check number is a short code, usually three or four digits, that helps identify each check within a series. It’s usually found at the top right corner of the check. Sometimes, banks might switch the account order and check numbers, but they’re both there to help keep track of your checks.

(Source: BarcodeLive)

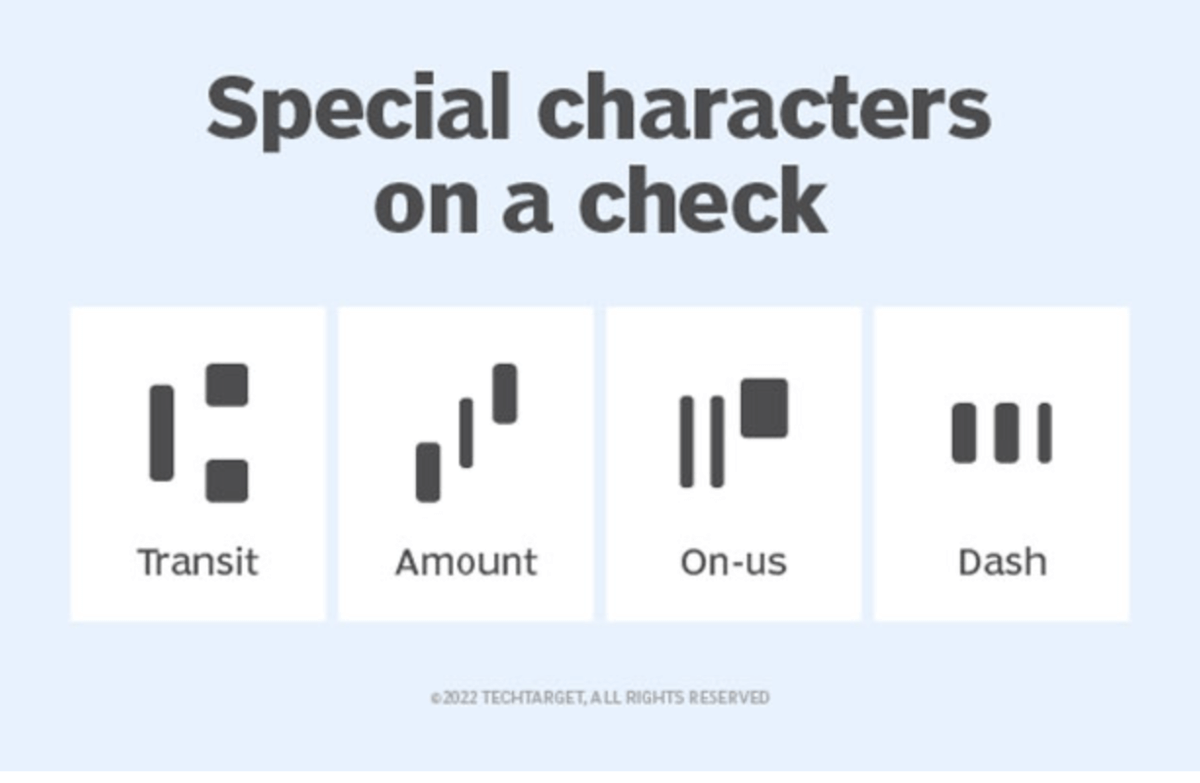

Additionally, four special symbols separate the banking, routing, and account numbers on checks. These symbols are called Transit, Amount, On-Us, and Dash. They help mark where the bank code, customer account number, transaction amount, and parts of the routing or account numbers begin and end.

Magnetic Ink Character: How Can It Be Read?

MICR can be read using machines called MICR readers. This magnetic ink character reader is used to sort, process, and check the validity of checks. When a document, such as a check, is scanned, MICR readers use a magnetic sensor called the MICR head to detect the magnetic ink and read the MICR characters. Each number has its own pattern, which the machine matches to the correct digit. But, these machines need to be fed checks at a steady speed. If it’s too fast or slow, the numbers printed using MICR magnetic ink might not be read correctly. So basically, MICR readers make sure checks are authentic and help banks handle them correctly.

Magnetic Ink Character Recognition: Advantages and Disadvantages

Magnetic Ink Character Recognition (MICR) is essential for banks because it helps process checks quickly and keeps our money safe. But, like anything, there are good and not-so-good sides to it. Let’s look at the advantages and disadvantages of MICR to understand how it affects banking.

Advantages

1. Keeps Checks Safe

In banking, keeping checks safe is important, and MICR plays a significant role in achieving this. It uses special fonts and magnetic ink that are hard to copy or change, making it tough for fraudsters to alter or fake checks. If someone tries to cash a fake check with a photocopied MICR line, the bank teller will know it’s fake right away using the MICR reader. This helps protect your money and keeps your transactions secure.

2. Speeds up Check Processing

MICR technology speeds up check processing by using special magnetic ink that machines can read fast. This helps banks and businesses handle lots of checks quickly and efficiently. So, you don’t have to wait as long for your transactions to go through, making your financial tasks easier and faster.

3. Makes Things Consistent

MICR is used worldwide to process checks, ensuring they all follow the same rules and designs. It keeps checks consistent in how they’re designed and coded, helping different systems work together, and lower mistakes. This makes it easier for banks and businesses to operate smoothly, as they can trust that checks will be handled the same way everywhere.

Disadvantages

1. Can be Costly

Using MICR technology can cost a lot because it needs special ink and printing, which can make running banks and other financial places more expensive. The good thing is, there are cheap MICR toners that you can use in printing.

2. Limited Characters

MICR can only read certain letters and symbols, so it can only be used for certain kinds of papers and transactions.

3. Environmental Impact

Making and throwing away toner cartridges for MICR can harm the environment, adding to electronic waste and pollution if not handled carefully. But, there are ways you can recycle cartridges.

MICR Printing: Things You Need For Printing

Printing checks with MICR technology requires some items to ensure accuracy and meet banking standards. These include special fonts, magnetic toner, printer, and specific paper. Let’s see what each of these does to help make checks that are secure and hard to change.

1. MICR Fonts

You need a set of MICR fonts that meet ANSI and ABA banking standards. These fonts ensure that the characters on the checks are encoded correctly and comply with banking regulations.

(Source: Digital Check)

The numbers on checks are often written in two unique fonts: E-13B and CMC-7. These fonts are used worldwide, but E-13B, like the picture above, is mostly used in North America, Australia, and the United Kingdom.

(Source: Digital Check)

On the other hand, CMC-7, like the second picture above, is more commonly used in Europe and some parts of South America. These fonts help machines read the numbers on checks quickly and accurately, no matter where they’re from.

2. Laser Printer

You must use a laser printer to print MICR-encoded checks. Special magnetic toner cartridges containing magnetic particles are required, as standard toner cartridges won’t work. HP printers such as HP LaserJet 1022n, HP LaserJet Pro P1566, and HP LaserJet Pro P1606dn, are often recommended for this purpose.

3. Magnetic Toner

MICR encoding requires magnetic toner, which is only available for laser printers. You’ll need to purchase MICR toner cartridges from specialized suppliers. CompAndSave offers cheap HP MICR toners, such as the HP 12A, HP 78A, and HP 36A MICR toner cartridge that you can use in the HP LaserJet 1022n printer.

4. Paper

Checks should be printed on special safety paper, which is designed to prevent tampering. This paper should be stored in a moisture-free environment.

MICR: Additional Ways To Use It

Apart from being used in banks to process checks, MICR technology is also handy in handling various money-related papers in the U.S. These include credit card bills, gift cards, money orders, and coupons for rebates. It helps ensure these transactions happen smoothly and safely. So, whether paying bills or redeeming vouchers, MICR tech helps keep everything organized and secure.

Parting Words

Now we know how MICR technology works! So, to sum up, Magnetic Ink Character Recognition technology is like a reliable helper for banks, ensuring checks are processed quickly and safely. It also keeps things consistent and helps prevent fraud, which is vital in banking. Even though there are new ways to pay, MICR technology is still really useful and isn’t going away anytime soon. It’s like a trusty old friend that banks can always count on to handle checks correctly, ensuring everything runs smoothly.

Key takeaways:

- The MICR line, also known as the MICR characters, is a strip of characters printed at the bottom left of a check. These characters contain essential information about the bank account and the check itself. The American Bankers Association (ABA) developed MICR technology in the late 1950s to improve check processing efficiency.

- Magnetic Character Recognition technology is vital for banking because it helps banks process checks quickly and accurately. Without MICR, handling a large volume of checks efficiently would be challenging for banks.

- Printing checks with MICR technology requires specific components, including MICR fonts, magnetic toner, a laser printer, and special check paper. MICR fonts are designed to meet ANSI and ABA banking standards and ensure that the characters on the checks are encoded correctly. Magnetic toner prints the MICR line on checks and is only available for laser printers.

If you require assistance ordering MICR toners for your laser printer, don’t hesitate to contact CompAndSave’s customer service team. You can contact us via our toll-free number: 1-833-465-6888, available Monday through Friday from 6am-4pm PT. We’re here to help you with your printing needs, so feel free to contact us. Happy printing!

Frequently Asked Questions

1. How do banks use MICR technology?

Banks use MICR technology to process checks efficiently. When MICR checks are scanned, MICR readers use a magnetic sensor to detect the unique magnetic ink characters printed on the bottom. These characters contain essential information such as the bank’s routing, account, and check numbers. MICR ensures accuracy in reading and processing checks, allowing banks to handle transactions swiftly and securely. Additionally, MICR helps prevent fraud by making it difficult to alter or counterfeit checks. Overall, MICR technology plays a crucial role in maintaining the integrity and efficiency of banking operations.

2. How can I ensure that my checks meet MICR standards?

To make sure your checks meet MICR standards, follow these steps. First, use special fonts that meet banking rules for encoding numbers correctly. Next, use a laser printer with a special MICR toner made for MICR encoding. Then, use special safety paper for printing checks to prevent tampering. Also, adjust your printing system to fix any spacing issues.

3. How can businesses benefit from implementing MICR technology?

Businesses can benefit from using MICR (Magnetic Ink Character Recognition) technology in various ways. Firstly, MICR helps process checks more efficiently, saving time and effort. This makes managing finances easier and more cost-effective. Additionally, MICR enhances security by making checks harder to change or fake, reducing the risk of fraud. By using MICR-encoded checks, businesses can follow banking rules and standards, ensuring smooth transactions. Moreover, MICR ensures accuracy in check processing, making financial management more effective.

Related Articles:

MICR Toner: Know How It Differs From Regular Toners

MICR Readers: Understanding How It Reads Magnetic Ink Characters